send link to app

Life Insurance for Living

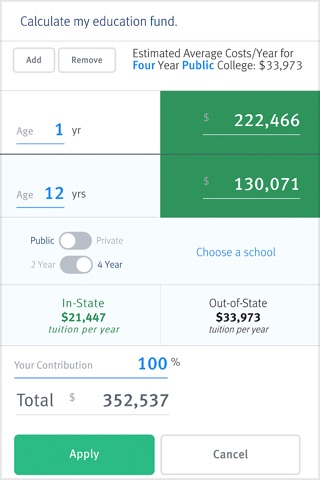

Partner with your clients to help quantify their need for life insurance. Guides you through a conversation that focuses on four key areas: Immediate Cash Needs, Income Continuation, Mortgage Fund, Education Fund.

Easy to navigate screens help you to record responses as you discuss your client’s life insurance needs. Includes worksheets on educational costs, final needs, and income replacement to help guide discussion.

Works in disconnected mode after authentication. Results are summarized in one place so you can discuss next steps. Can store multiple client profiles.